Commercial Flood Insurance in New Jersey

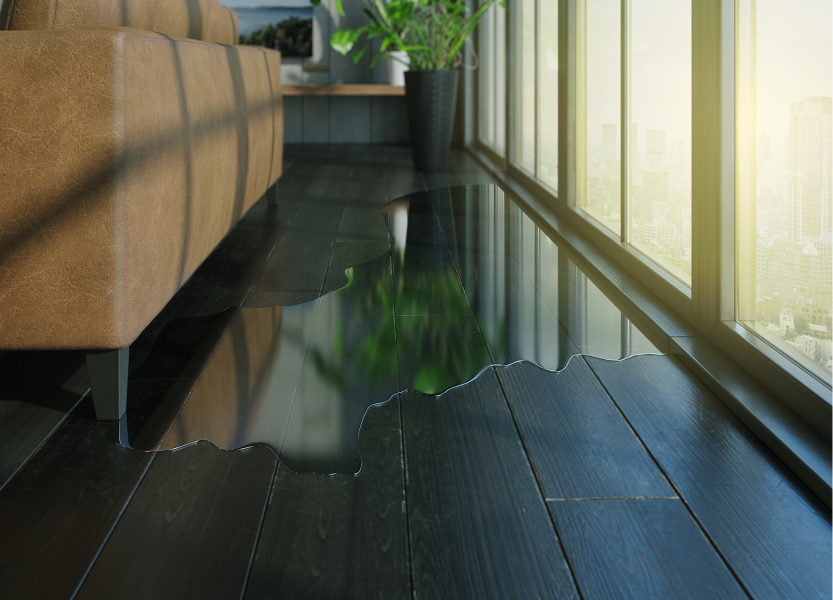

When the Water Rises, Be Ready

Floods can devastate commercial properties in minutes—damaging structures, destroying inventory, and halting business operations. In a state like New Jersey, where coastal storms, heavy rainfall, and overflowing rivers are common, flood insurance is not just a precaution. It is a critical layer of protection. LG Insurance Agency offers Commercial Flood Insurance that helps property owners recover quickly, reduce financial losses, and keep business moving forward.

Get a QuoteWhy Flood Coverage Matters for New Jersey Businesses

Many property owners assume their standard commercial policy includes flood damage. Unfortunately, it does not. Flood insurance must be purchased separately, and without it, property owners often pay out of pocket for cleanup, repairs, and lost revenue.

Common causes of flooding in New Jersey include:

- Coastal storm surge from hurricanes and nor’easters

- Flash flooding from intense rainfall

- Overflowing rivers and streams after snowmelt

- Urban drainage backups in cities like Newark and Jersey City

Flooding does not only affect properties near water. Even inland locations and properties outside high-risk zones can be impacted.

Get a QuoteWhat Commercial Flood Insurance Covers

Commercial Flood Insurance helps cover losses related to rising water or surface water intrusion. A policy may include:

- Building structure and foundation

- Electrical and plumbing systems

- Central air, heating, and water equipment

- Interior walls, flooring, and built-in fixtures

- Business personal property and inventory

- Cleanup and debris removal

Some policies may also offer additional coverage for business interruption or equipment breakdown caused by flood-related issues.

Get a QuoteWho Needs Commercial Flood Insurance in New Jersey?

- Retail stores and shopping centers

- Apartment buildings and condo complexes

- Medical and dental offices

- Warehouses, storage facilities, and industrial plants

- Restaurants, cafes, and entertainment venues

- Professional buildings and leased office spaces

If your property has a basement, is located in a coastal or low-lying area, or has ever experienced drainage issues, flood insurance should be part of your protection strategy.

Get a QuoteHow Much Does Commercial Flood Insurance Cost in New Jersey?

The price of commercial flood insurance varies depending on the property and its location. In moderate- to low-risk areas, premiums can be relatively affordable—often starting around $500 to $1,500 annually. For properties located in high-risk flood zones, premiums typically range from $2,000 to $10,000+ per year, depending on building size, value, and use.

While the cost may seem high in some cases, the coverage can help prevent tens or even hundreds of thousands of dollars in losses after a major storm or flood. Getting a custom quote is the best way to determine your property’s actual cost.

Get a Quote

What Factors Affect the Cost of Commercial Flood Insurance?

Several elements play a role in determining your commercial flood insurance premium in New Jersey:

- Property Location

Buildings in high-risk flood zones near coasts or rivers typically face higher premiums. - Elevation and Foundation Design

Buildings elevated above base flood elevation can qualify for lower premiums. For example, raising a structure even 1 to 3 feet can reduce rates significantly. - Building Size and Use

A small commercial unit under 2,000 square feet may cost far less than a 15,000-square-foot mixed-use facility.

- Coverage Limits and Deductibles

Selecting coverage limits over $500,000 or deductibles under $5,000 will usually result in a higher premium. - Construction Age and Materials

Buildings constructed after 1980 and compliant with modern flood codes often receive better pricing compared to older buildings built before current standards.

Flood Risk is Changing in New Jersey

Rising sea levels, heavier rain events, and changing climate patterns are increasing flood risk across New Jersey. Cities and suburbs alike are seeing higher frequencies of flooding in areas once considered low risk. Commercial properties in Union City, Trenton, Toms River, and many other communities are facing new threats each year. Flood maps do not always tell the full story—so preparation is essential.

Get a QuoteWhy Choose LG Insurance Agency for Commercial Flood Coverage?

At LG Insurance Agency, we understand that flood risk in New Jersey is complex and constantly evolving. Here’s why business owners across New Jersey trust us with their commercial flood insurance:

Protection Starts Before the Storm

Flooding can happen quickly, and when it does, your coverage needs to already be in place. LG Insurance Agency helps you stay one step ahead by offering Commercial Flood Insurance that reflects the real risks New Jersey businesses face. We make preparations simple, proactive, and built around your property’s needs.

Get a Quote

Frequently Asked Questions (FAQs)

Flood insurance is not required by the state, but federally backed lenders will require it if your property is in a high-risk flood zone.

Yes. In fact, properties in moderate- or low-risk zones account for many flood claims. Coverage is often more affordable in these areas.

Some structural elements in basements may be covered, such as mechanical systems or foundational walls, but personal property in basements may have limited coverage.

Some commercial flood policies offer optional business interruption coverage. This can help replace lost income, cover payroll, and support temporary relocation if your property becomes unusable due to flood damage.

Claims timelines vary based on the insurer and severity of the damage. With LG Insurance Agency, you receive support throughout the process. We help you document losses, coordinate inspections, and push for a timely and fair settlement.

Get a Quote

Secure the protection your property deserves before the next storm hits.